There’s no one perfect guide to approaching pocket money with children, as conversations naturally evolve as children get older.

But there are a couple of key questions that parents always come back to – typically related to ‘how much’, ‘where’ and ‘when’. To help answer some of these burning questions, we’ve offered our take on the pocket money debate below.

How much money should my kids receive?

This is a question we often hear, and it’s definitely an important one – no one wants to feel like they are shortchanging their children, or conversely paying way above what their friends are receiving!

There is definitely no set answer, but it will depend on a range of factors: how old your child is; whether they’re being home-educated or going into school; what you intend the money to be used for; where you live (to name just a few!).

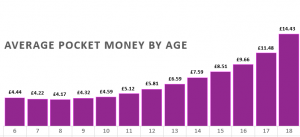

If you’re after a ballpark figure, the latest nimbl data shows that kids aged 6 to 11 receive an average of £4.48 per month, whilst 12 to 18-year olds receive an average of £9.15 in monthly pocket money payments.

How often should I pay allowances?

A bit like the above, this totally depends on your way of doing things as a family. Some might opt to send money at the start of each week, whilst others might prefer paying on a monthly, or even an ad-hoc basis.

The nimbl mobile app has been designed to make it easy for parents to set up regular digital pocket money payments, with the option of paying in on either a weekly or monthly basis (and you can even choose the day your kids receive it too). Though not always the case, we tend to find parents with younger children prefer small, consistent top-ups which can help keep them on track as they take their first steps with money. For more experienced teenagers, a monthly allowance often works well – particularly good for budgeting and testing their ability to make their money stretch!

What if I want to give my child a one-off top-up?

As well as monthly or weekly allowances, it’s always nice to be able to offer children a treat every now and then as a little reward – whether that’s for doing their chores, trying really hard with their studies, or showing kindness to a friend at school.

Instant top-ups, which are easy to pop through using the mobile app, are perfect for this and allow you to supplement regular payments with just a few taps. Or alternatively, if your son or daughter has been particularly generous to a neighbour or relative, and they’d like to send a little note of thanks in return, they can do so using our easy-to-use gifting links.

Whilst you can’t technically put a price on chores or being helpful around the house, as an indication of the going rate, Money.co.uk’s recent poll suggests that UK parents typically pay out £2.38 for doing the dishes, whilst doing the laundry comes in at a more profitable £2.92.

Above all, remember that what might work for one family might not be the best option for you.

If you have any extra pocket money top tips you’d be keen to share with other parents let us know by reaching out to our Instagram, Twitter or Facebook pages – we’d love to hear from you!