Two apps. One smart way to learn about money together.

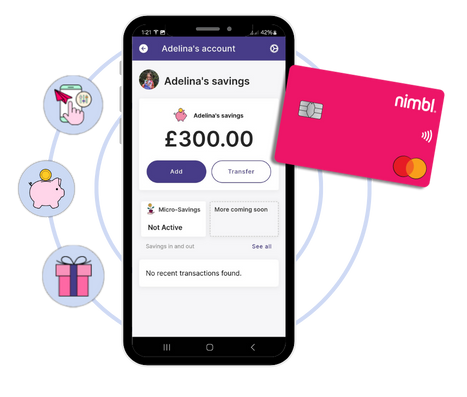

With nimbl, you get a parent app to stay in control – set limits, track spending, and manage pocket money in real time. There’s also a child app designed just for them – age-appropriate, optional, and made to build confidence.

The nimbl apps – made for parents and children

Managing pocket money is simple with our two connected apps – one for you, one for them. If they’re not ready for the child app, no problem – everything can be managed from the parent app alone.

You stay in control

Use the parent app to set pocket money, approve Tasks, top up, freeze the card, and track spending in real time.

They learn by doing

Your child gets their own login to check their balance, complete Tasks, move money to savings, and receive spend alerts.

Build money confidence – together

With shared visibility and flexible features, nimbl helps families turn pocket money into lifelong money skills.

Parent App – At-a-Glance

- Instant notifications for every spend

- Set regular pocket money – weekly or monthly

- Create and approve Tasks for extra earnings

- Freeze or unfreeze the card anytime

- Top up on the go in just a few taps

- View real-time balances and savings goals

- Set spending limits and block certain retailers

Everything you need to stay in control – all in your pocket.

Child App – At-a-Glance

- Their own login – for independence with supervision

- Move money to the savings pot

- View and complete Tasks for extra earnings

- Get their personal gifting link to share

- Instant notifications when money is spent

Everything they need to – start managing money safely and simply.