Did you know that financial health is linked to both physical and mental wellness?

We’ve decided to turn Blue Monday on it’s head by giving you some quick top money tips you can accomplish with your children by the end of the day.

Don’t let Blue Monday get you down, instead use it as the day to kick-start routines of your children’s financially bright futures. Here’s some tips on how to do just that:

No 1 – Find the right (account) balance

Helping your children understand their account balance and statements is a fantastic exercise. Not only is it a positive money conversation starter amongst families but also helps children get to grips with how much they have spent this month or the past few months and on what items.

Did they splurge or save? And what are they going to do differently going forward?

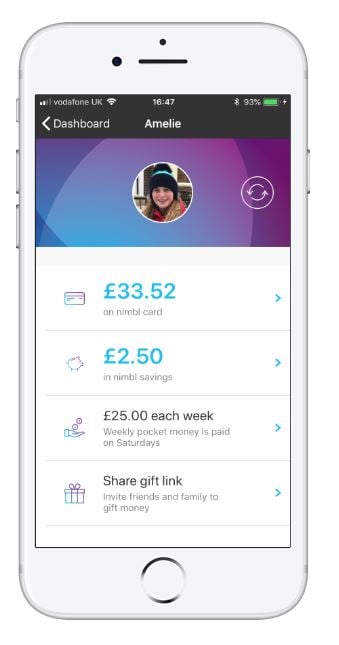

With the nimbl app, children (and parents) are able to view the child’s card balance and monthly statements – making them fun and easy to understand.

Sit down with your children to talk about their balance:

- How much do they expect to see in their card balance

- How much are they able to spend for the rest of the month

No 2 – Save it!

Saving is hard for adults, let alone for children. The first step to a healthy saving cycle, is to try and establish a difference between needs and wants. Planning and putting money away for something you want also takes self-control and dedication, so teaching your child to save themselves for an item they want is a good all round task.

Birthdays are also a good time to boost children’s savings, with nimbl’s gifting feature, money is paid directly into the child’s savings account, getting rid of unwanted presents altogether, plus helping children reach their saving goal quicker!

nimbl has a separate savings account for children to deposit money as and when they choose to. Our super saving feature micro-savings also help children find a balance between spending and saving by paying a set amount into the child’s savings account every time the nimbl card is used.

Sit down with your children to talk about their savings:

- What are they saving for?

- Can they turn on micro-savings to help boost their savings balance

Let us know if you feel better after talking about money with your children and if it helps them to understand their money habits better – we’d love to hear from you!